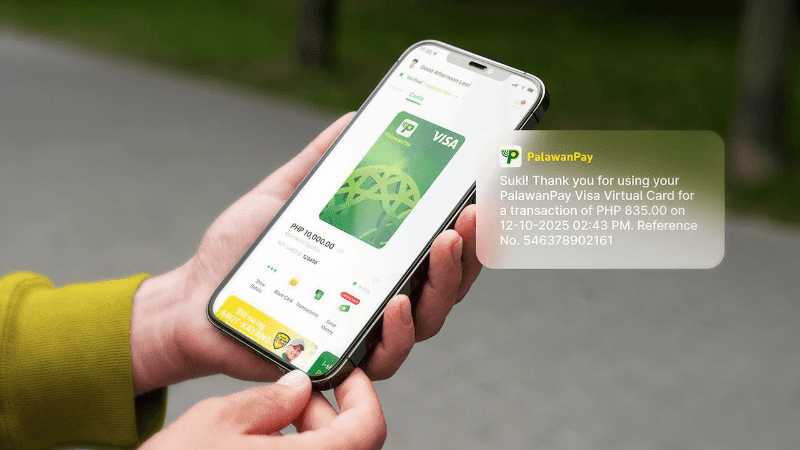

The Palawan Group of Companies has introduced the PalawanPay Virtual Visa Card. This new offering aims to enhance digital payment accessibility for Filipinos, particularly those without bank accounts or credit cards.

Verified users can quickly activate their Virtual Visa Card through the PalawanPay app and begin online transactions with ease. The card can be utilized for various purposes, including e-commerce shopping, bill payments, travel bookings, and streaming subscriptions, providing a safer and more seamless payment experience.

Key benefits of the PalawanPay Virtual Visa Card include:

– Easy payments for online shopping platforms like Shopee and Lazada, as well as travel bookings and subscription services.

– Safe and secure online bill payments.

– Secure money transfers powered by Visa Direct.

– Empowerment of unbanked and underbanked Filipinos to engage confidently in the digital economy.

PalawanPay CEO Third Librea emphasized that the card aims to make Visa access more inclusive for all Filipinos, stating that it is designed to be simple and practical. Bernard Kaibigan, Chief Marketing Officer of Palawan Group, added that the Virtual Visa Card represents a step toward a more inclusive digital economy.

Additionally, the company plans to roll out a physical Visa card by 2026, which will further enhance payment flexibility for in-store and point-of-sale transactions. PalawanPay users can also receive remittances directly in the app and enjoy free cash-in services at over 3,500 Palawan Express branches across the Philippines without any extra cost.

—